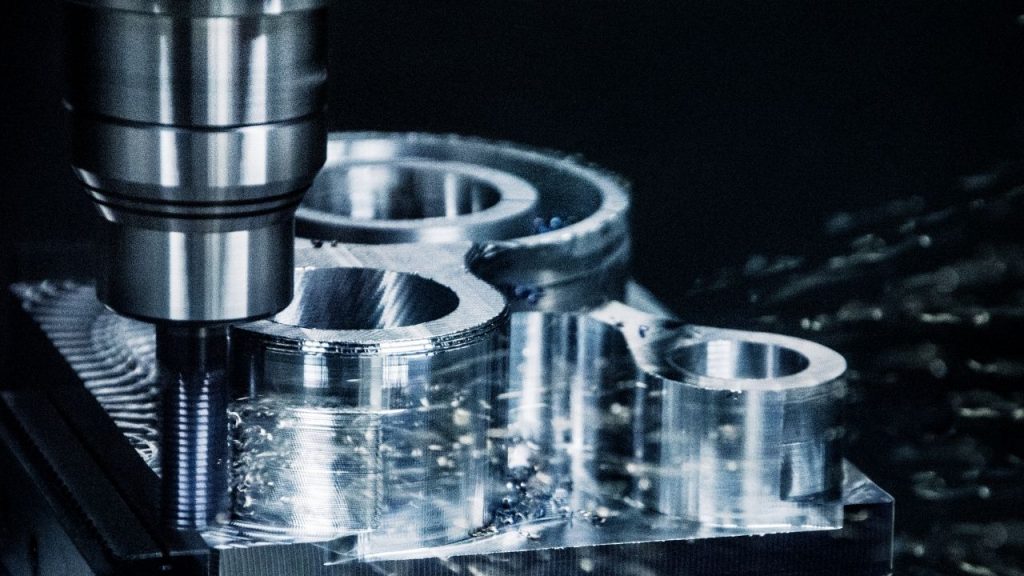

If you’re like most business owners, you rely on big and expensive machinery to help get the job done. Whether it’s a huge construction vehicle or a delicate piece of medical equipment, losing that machinery can be a serious setback – not to mention an expensive one. Machine insurance protects you from the costs of repairing or replacing any items damaged by unforeseen events. You’ll want to have a policy tailored to the type of equipment you have so it covers all potential risks.

For most businesses, the cost of machinery insurance is a small price to pay for the peace of mind it brings.

Machinery Insurance: Know Your Options

When you’re shopping around for an insurance policy, start by deciding what types of equipment you want covered and how much protection they need. Understanding the different types of coverage also helps you determine how much insurance to buy.

Just like any other kind of insurance, machinery insurance also has various coverage options. Here are some of the most common ones:

Property damage

This covers the cost of repairing or replacing your equipment if it’s damaged or destroyed by an event like fire, theft, or vandalism. Property damage coverage also covers the cost of repairing your business’ property in case it’s damaged by a covered accident.

Property insurance can be purchased separately from machinery coverage, but if you have expensive machines and don’t want to pay for two policies – one for machines and one for buildings – consider combining them into one policy. You’ll usually save money that way.

Collision

This type of coverage pays for the cost of repairing or replacing your equipment if it’s damaged in a collision. It also covers any damage to other vehicles or property involved in the accident. Industries where vehicles are often in motion – like construction, transportation, and waste disposal – usually have higher rates of collisions. You can lower your insurance costs by taking safety precautions such as banning cell phone use or limiting the use of radios while driving the equipment around.

Comprehensive

This type of coverage protects your equipment from all sorts of risks, not just collisions. Events that are typically covered include fires, storms, vandalism, and theft. Comprehensive policies usually have a higher deductible than collision or property damage policies, so be sure to compare rates before you buy.

Business Interruption

Machinery insurance covers the cost of replacing or repairing damaged items, but it doesn’t cover your business’ income. If a piece of machinery is lost due to an event that’s covered by property damage coverage, you could be out of work until repairs are finished and new equipment arrives. Business interruption coverage can help fill in those gaps with cash payments to help you keep your business running while you’re waiting for things to get back up and running.

This is a necessary coverage to have if your business relies on machines to make money. Keep in mind that it only covers lost income, not expenses like rent or payroll, so make sure you have those covered separately.

Surge

Like business interruption, surge coverage helps cover the cost of replacing or repairing equipment damaged by an event covered by your policy. The difference is that this type of insurance covers more types of machines and events than business interruption does – including earthquakes, tornadoes, explosions on nearby property, vandalism during a power outage, certain weather-related damage, and more.

If you live in an area that’s prone to natural disasters, surge coverage is a must-have. It can also be helpful if your business is in a high-risk area for things like vandalism or theft.

As with any type of insurance, it’s important to shop around and find the policy that best suits your needs. Machinery insurance can be expensive, but it’s a lot cheaper than replacing or repairing damaged equipment. Treat it as an investment in your business – and a bargain compared to the cost of replacing or repairing damaged machinery.

has a different influence on the antenna. It is necessary to first understand it and then move on with the best TV antenna installations process.

has a different influence on the antenna. It is necessary to first understand it and then move on with the best TV antenna installations process. Since the TV signals there would be stronger, therefore, you will better reception.

Since the TV signals there would be stronger, therefore, you will better reception.